🚨🚨🚨 WARNING!!! 19 Year Dollar Channel is Now Broken!

#dollar #dxy #gold #silver #commodities #energystocks #gas #naturalgas #preciousmetals

Trading Fam,

The title is NOT clickbait. If you’ve been following me for any length of time, you’ll know I have been warning you about this exact moment for some time. We’ve had many signs. Many clues. But the price of gold and silver rising exponentially was our crystal ball. And now, price movement on the U.S. dollar has confirmed to us that the dollar will continue its descent. For the first time in 19 years, the dollar has dropped from its ascending channel. The price of everything is about to increase. Be prepared.

Let’s take a look at our chart.

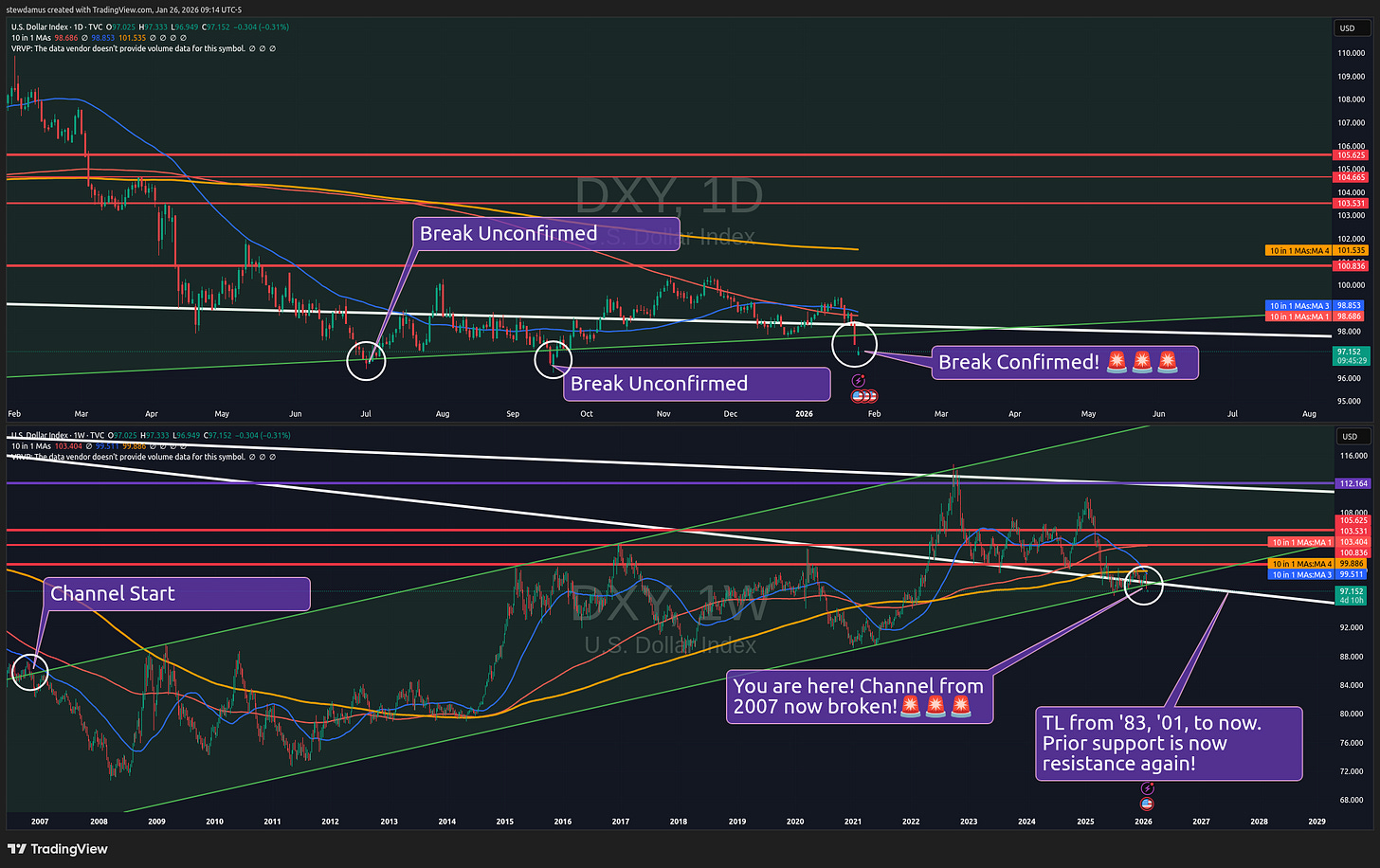

In the upper rectangle, you’ll see the U.S. dollar on the daily. We have existed inside this channel for 19 years. And for 8 months now, we’ve been consistently hammering away at the bottom of our channel, which has been acting as strong support. 19 years’ worth of strong support. Today, we finally confirmed a break below this support.

Two times in the past, once in July of last year and once in Sept., we did break the bottom of the channel. But we received no confirmation. We were looking for a lower low closing candle, but we never received that, and somehow we escaped back into our “safe” zone, the channel. Today, the break from our channel is looking like it will be confirmed. Yes, we do have to wait and see where our candle will close. But the reason I am confident this is our move is mainly because of that overhead trendline (white) coming all the way from 1983, drawn through a couple of tops in 2001, and extended through today. This will now act as major resistance. And it intersects almost precisely with the bottom of our 19-year channel!

This is not good. It means the price of everything is about to inflate even more than it already has. Any student of monetary history will know that all fiat currency always only ever ends in hyper-inflationary recession/depression. I’m not saying we are at that point yet. But maybe we are? Or is this time different? Whatever the case may be, we can’t cling to hopium to preserve our cash. We must take steps to hedge against this massive deterioration of our dollar that will continue to occur.

So, what do we do? Where do we go from here?

My suggestion is to concentrate on acquiring assets that the FED cannot print! This would include things like physical gold and silver. I have long been a proponent of the 4 “G’s” in investing/hedging strategy. Each “G” is symbolic of a larger class of commodities that will do well to keep one safe in both times of inflationary pressures as well as deflationary pressures. The 4 “G’s” are these:

Gold - anything categorized as precious metals

Ground - real estate providing tangible value and income potential

Guns - again, not literal. So, don’t let this scare you. But to keep the alliteration alive, guns stand for anything physical that can be used to protect your wealth. Usually, this comes in the form of something metal. Whether that be a safe, a tractor, or an iron tool that is hard to get, these tools can be used to protect your property, your precious metals, and anything else that is considered of value. Some may interpret this to be defensive type stocks.

Gas - energy-related stocks and investments

How you acquire the above-listed and by what means is entirely up to you. But I don’t think you can go wrong. In the great depression, these categories saved people. In any sort of inflationary recession/depression, they are also most likely to do the same, and they will always hedge against a currency devaluation and an economy that can no longer be controlled.

✌️Stew

What do you recommend on gas? I bought silver when it was $14. Should have bought more. 😆