SPY hits new high! And Bitcoin on the way to 68k!

The week ahead for stocks and crypto.

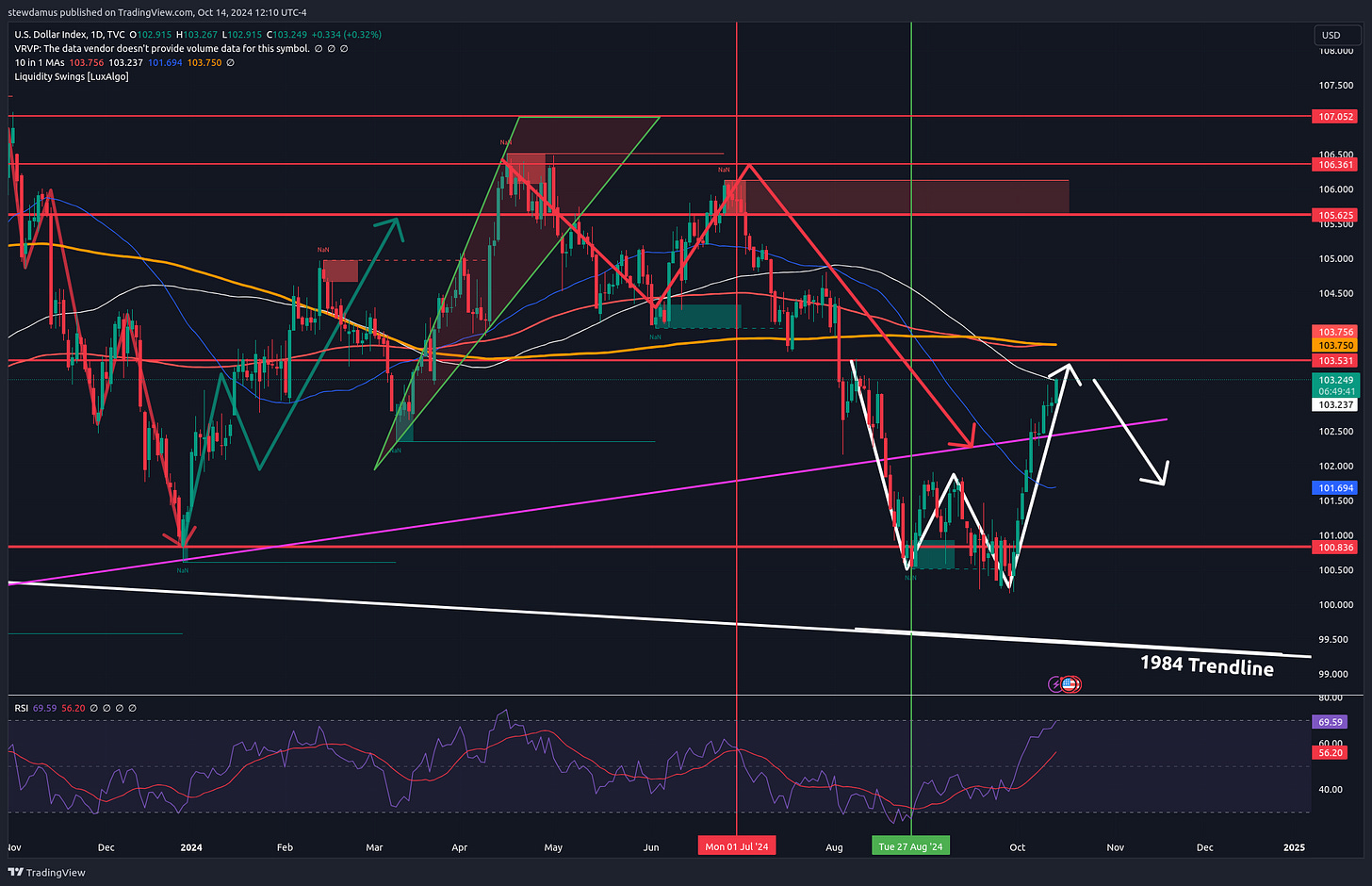

The dollar is stronger than I anticipated, thanks in large part to foreign economies dropping interest rates. It blew right through where I thought it might meet some resistance and it headed to that 103 level again. Will that be where we see it pause? Not sure, but just above it you will see the 200 and 350 DMAs providing even stronger resistance. We’ll soon see how this plays out. My bet is that we see it pause at one of those two resistance points.

The VIX has moved up slightly but is still remarkably low considering all that is going on in the world and how close the world is to nuclear war, etc. But, the VIX being down is almost always a good sign for the markets and continues to support my blow-off top thesis.

U.S. oil has hit major resistance in the 200 and 350 DMA and that large sell-side liquidity block. As anticipated, oil is dropping once again. Cheap energy, represented here by oil, is always a good sign for the markets. Pair this with housing which is also coming down in price and you have a duo of indicators that is very positive for the markets.

As anticipated then, the SPY has and should continue to make new highs as the market enters a new state of euphoria. Final target remains 650-700. But we will have to watch 600 closely as we could suffer some resistance here. It may be wise to trade half out at this point, wait for a pull back, and then re-enter.

Bitcoin dominance remains inside its long-trending bearish ascending wedge. Quite honestly, it could remain inside of this wedge until Jan-Feb of ‘25. This would put back the altcoin bull run until next year.

But the Total3 is still bullish. Therefore, alts still have a chance to at least keep pace with BTC until its dominance drops from the aforementioned wedge.

And that brings us to Bitcoin. Bitcoin is looking to test the top of our descending channel once again at around 67-68k. If it fails to break this, we could see one more final pullback all the way back down to the bottom of our channel or even lower as the market becomes exhausted with this accumulation phase.

Overall, both stonks and crypto are right on track. Obviously, Bitcoin is divergent from stocks to some degree but this would change if we broke the descending channel to the upside. This will be where our battle should be found. Watch this area closely and be ready to take some profit here.

In other news, I am having fun experimenting with trading very tiny amounts of leveraged capital on Storm. I expect this platform to become more and more popular as traders are made aware of the potential here on this DEX.

Check out the 75% profit I made since just yesterday!

Granted. These are just tiny tiny amounts I am playing with until I am comfortable with the way the platform works. But still. If you are interested in these type of trades on the TON network, here’s my link:

https://app.storm.tg/?ref=4A9K27WqG5

Best,

Stew