Subscribers,

As mentioned quite a few times already, I have implemented a new trade indicator which I have tested extensively during this last month. During this time 23 trades were executed and closed based upon this indicator. 12 of these closed trades were in crypto. 11 trades were closed in stocks. I still have 3 trades open in crypto, 2 of which are in floating profit right now and 1 open in the stock tracker which will also close in profit. Out of the 23 closed trades this last month, we only had 2 losses and those were due to being stopped out. As of this moment, both of those trades are also currently positive. The 2 losses came in crypto. 1 of these crypto trades was on a smaller cap alt which seems to have less reliability from my indicator. Of the 11 stock trades that we closed, 100% were winning trades, even the degen play on Gamestop!

I am super excited to have finally achieved this type of success rate and hope I can prove to you all just how valuable following this indicator will be. I am especially thankful and humbled by my loyal following of paid subs who stuck with me all these years as I tried my best to learn and improve at trading right alongside you all. I hope that I can finally say that your payday is coming as we blast through these trades, winning all the way!

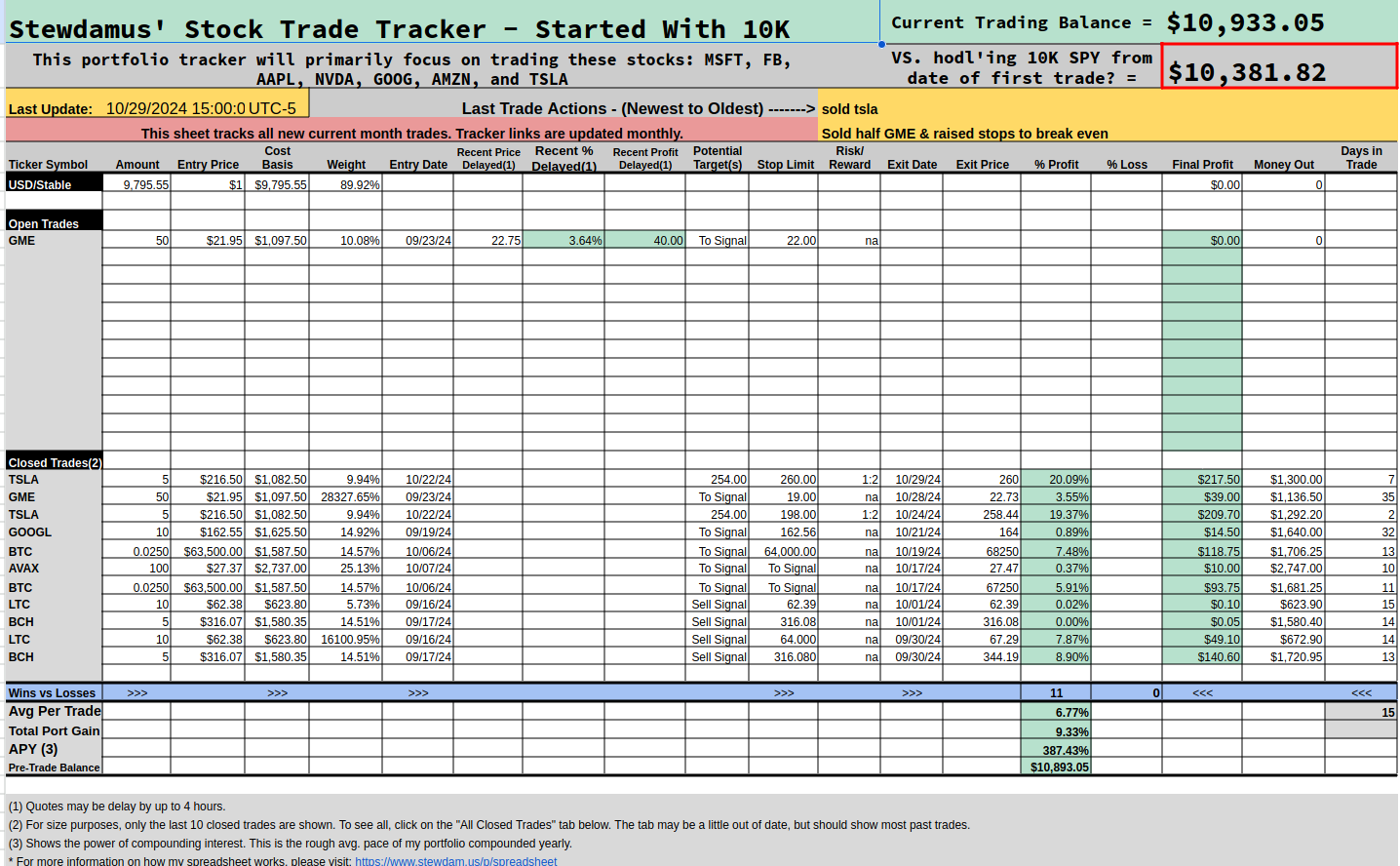

With that said, it is time to retire the old tracker. I know we had a goal of turning 10k into 100k in 3 years and with 6 months left and the alt bull run, that is easily still attainable. However, I want to start fresh with data exclusively from the implementation of my new indicator. Therefore, I am resetting the new tracker to a 10k balance and we’ll do it all over with the same goal in focus. Honestly (and I know this may be met with some skepticism), I think we can hit 100k easily within three years on both the crypto and stock tracker. Heck, just last month with only 11 closed trades, we made almost $1,000 on our 10k with the stock tracker! The crypto tracker was a little less clear due to some of the older trades I had been holding till profit and again, the reason I want to separate my data here. But we were still almost as profitable. Take a look at the stock tracker from this last month:

You’ll notice that there were some crypto trades that were closed out. That was because I was still unsure about what my plan was going forward. I have since decided to only trade stocks on one tracker and to only trade crypto on the other.

On the stock tracker, we will primarily focus on trading the magnificent 7: MSFT, FB, AAPL, NVDA, GOOG, AMZN, and TSLA. At the top right, you will always see our current trading balance vs. what it would be if we held SPY (S&P500). That, of course, is really easy to beat and is not the goal. The goal is 100k in 3 years. But I put that data up there primarily as a reference to show how profitable successful trading can be vs. holding. Our APY calculates at 387%! This means at our current success rate, we will have turned 10k into $38,700 in one year by trading! If we kept that success rate for just one more year, our 10k would already be $149,769! If we did that again in year 3, we’d have $579,605. This is the power of trading and compound interest. So, you can see, turning 10k into 100k in 3 years is not as remarkable of a goal as it might first appear. LFG!

Indeed, just this month alone, trading 10k netted my followers $933. I only charge $500 for a WHOLE-YEAR subscription to my trade alerts (HINT, HINT)!

The crypto spreadsheet will be in the same format but the trade balance will be compared to a BTC hodl’er vs. SPY. This will be a bit harder to beat but still easily achievable. Again, our real goal here will be 10k to 100k in three years. And with the crypto tracker, I will be primarily focused on trading the largest cap cryptos, let’s say the top 15 or so, with some occasional trades on some smaller cap cryptos that I like to track.

I’ve included the last 3 open trades on the new tracker but because we reset the portfolio down to a 10k balance I had to adjust proportionally the size of our entries into each trade. Remember, I generally don’t want to allow more than 20% of my portfolio to a single trade, and on higher-risk trades, I like it to be less than 10%.

Also, to get my spreadsheet formulas to play nicely, I had to include at least one closed trade. I chose our leader, Bitcoin. Due to Bitcoin’s big pump recently, we’re currently behind the BTC hodl’ers right now, but with altcoin season soon approaching, I am hoping to make up this ground rather quickly.

If there are any further questions about the new trackers, please post them in the comments below or DM me.

Now, here are your new tracker links: