And now some cautionary charts

#bitcoin #crypto #stocks #altcoins

Traders,

Though my post yesterday reflected more bullish sentiment, I would be remiss not to acknowledge a few of the contrarian indications that I am also spotting on various charts which suggest we could still experience more of a drawback in crypto before Bitcoin crosses to the topside of that all-pervasive $30,500 resistance overhead. Let’s take a look at a few of the charts which seem to suggest this possibility.

#1. DXY

The dollar is now expected to continue moving up in strength. I see the next line of resistance at 105.6. Dollar UP + VIX UP = Stocks DOWN (generally).

#2 VIX

The fear index (VIX) is at a multi-year low. Considering all that is going on in the world recently, it is highly likely that the VIX will spike again soon taking us back above our 200 day moving average. Dollar UP + VIX UP = Stocks DOWN (generally).

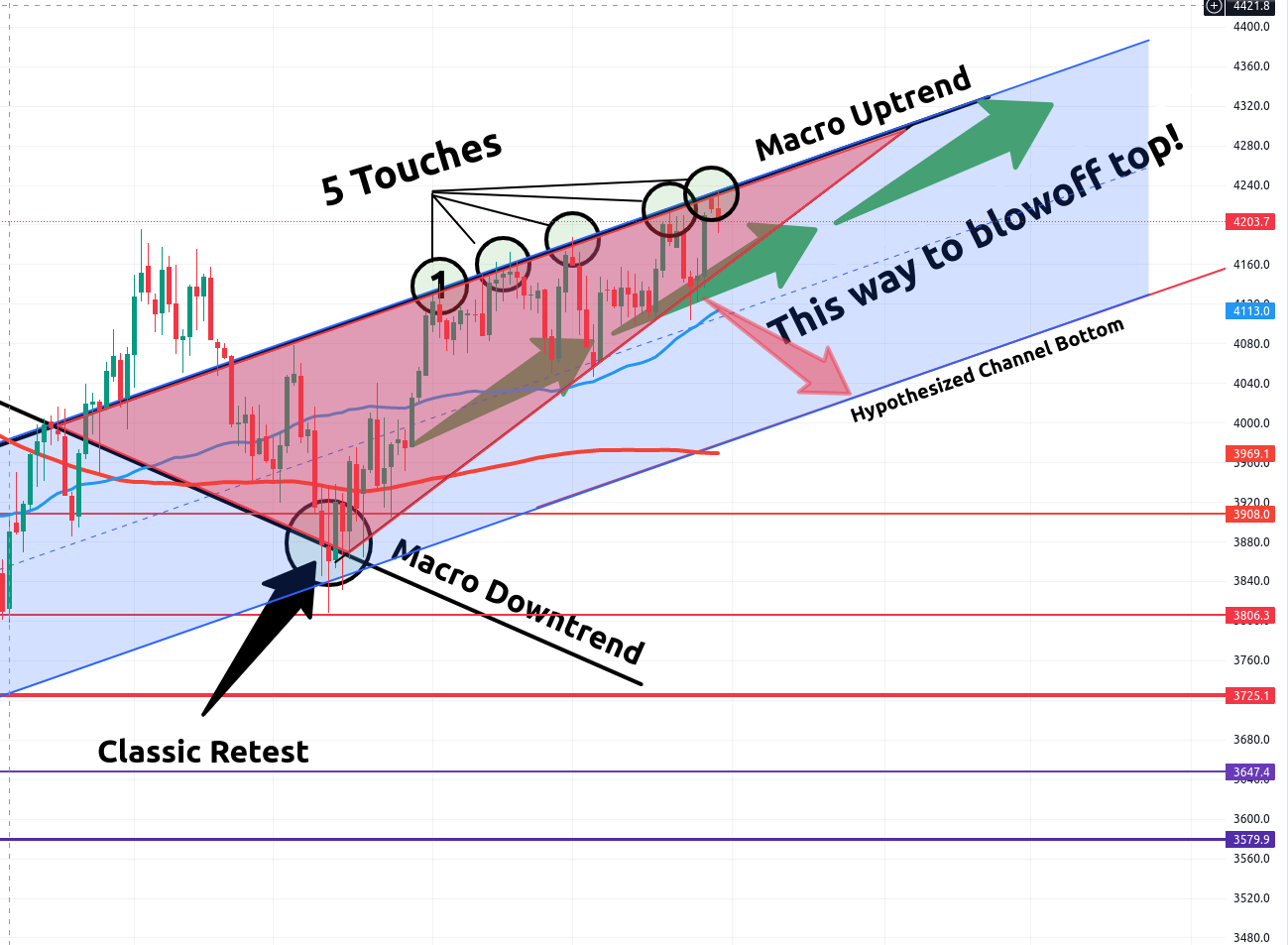

#3 US500

I have been using our US500 chart to pattern what the rest of the market might do on a swing scale timeframe. I have been calling for a break down from the ascending red wedge. Should this occur, crypto is likely to follow.

#4 Bitcoin CME Futures

A new gap was created below us on the Bitcoin CME futures chart. 99% of all gaps are filled …usually sooner rather than later.

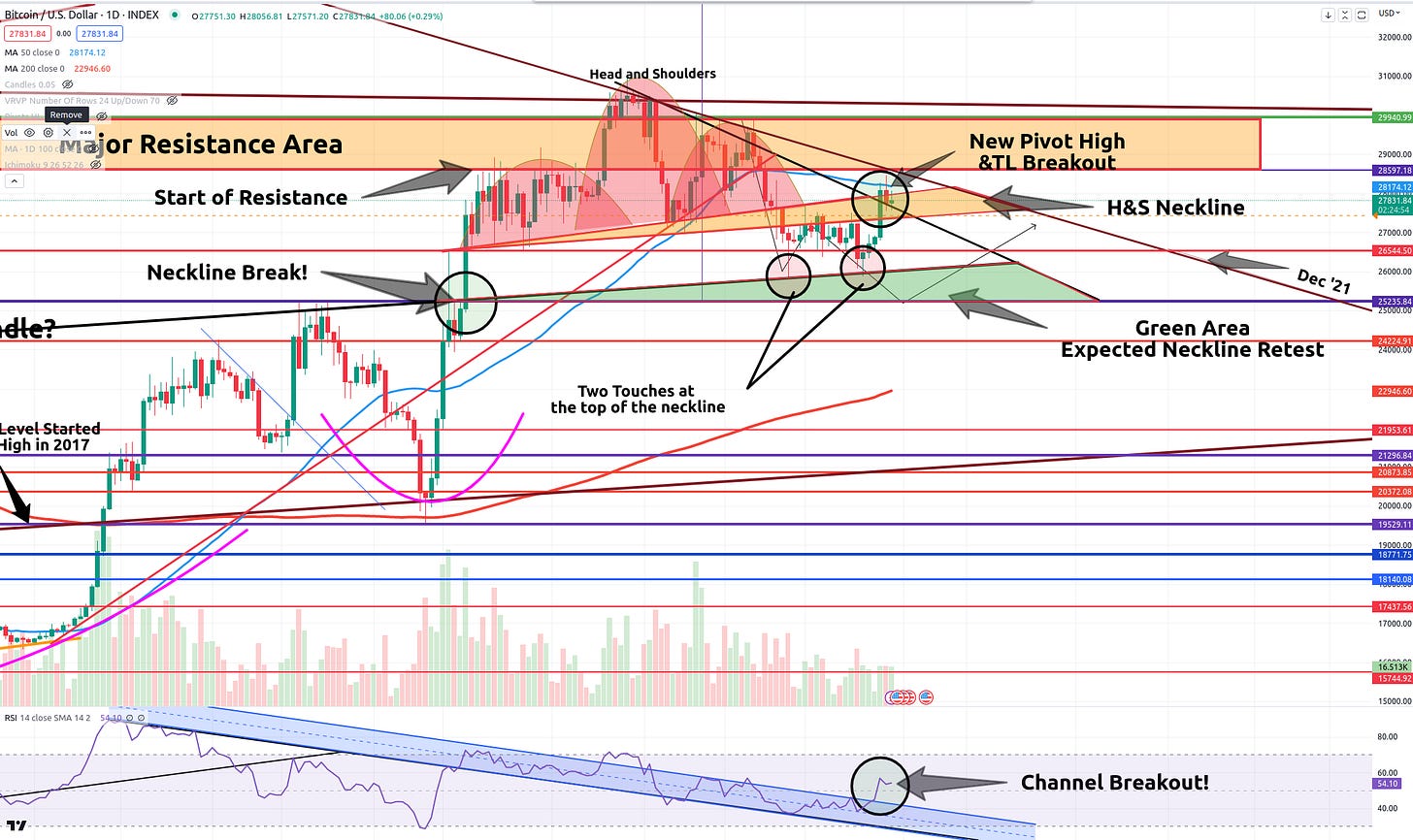

#5 Bitcoin

Yesterday, I pointed out more than a few bullish indications for Bitcoin. But I also want to remind you that we’re not out of the woods yet.

One, I already mentioned that we have not defeated our overhead resistance, that big orange area above us along with the $30,500 mark.

Two, we have not confirmed a move above our orange neckline area.

Three, I was expecting more of a test in that green area below us which is the neckline of our larger Cup and Handle pattern. I was surprised that we did not get more of a test in that area. But, we still may.

I do not plan on selling my current trades, which are all in the profit, just yet. But should BTC dip back below that black trendline it is currently using for support, I just may.

Stew

⛓️ 🔗 Useful Links 🔗 ⛓️

My site:

My Twitter:

My Telegram:

My 10k Portfolio:

https://dropstab.com/p/stewdamus10k-portfolio-9tqk00rtld

All my socials:

https://stewdam.us/p/social-media

Buy Me a Coffee (sign up at Binance):

https://www.binance.us/register?ref=54956984

My Spreadsheet Trade Tracker: